Europe’s Long March on Chinese Subsidies

In

- EU and strategic partners,

- EU strategy and foreign policy,

- Europe in the World,

- European defence / NATO,

Not police officers but inspectors from the European Commission’s Directorate-General for Competition led the raid at Nuctech in Warsaw and Rotterdam on 23 April. At the Chinese security equipment manufacturer, they were looking for any evidence of financial support that Nuctech allegedly enjoyed from the Chinese government.

*****

Europe’s Long March on Chinese Subsidies

Not police officers but inspectors from the European Commission’s Directorate-General for Competition led the raid at Nuctech in Warsaw and Rotterdam on 23 April. At the Chinese security equipment manufacturer, they were looking for any evidence of financial support that Nuctech allegedly enjoyed from the Chinese government. Many member states – including Belgium in 2021 – had already sounded the alarm about the espionage risk when using Nuctech’s scanners. However, the raid had nothing to do with security concerns, as it was part of a wider investigation into companies using foreign subsidies to distort the European single market, providing us with insight into how Europe will approach China’s geoeconomic prowess.

Over the past years, the European Commission has greatly strengthened its arsenal against unfair competition from beyond the EU’s borders. It also took a more critical tone towards China under President Ursula von der Leyen. A comparison with the American posture towards China, however, should be preamble: Europe is not bandwagoning the American approach, rather it is pursuing its own agenda.

All major powers agree that the global trade regime needs to be rebuilt. However, they disagree as to how this new global trade regime should look like.

Although China is widely considered the big winner of the current trade constellation, the Chinese economy is currently facing major internal economic challenges. Since the pandemic, President Xi Jinping has tried to revive sluggish growth by diverting investment from the debt-plagued real estate sector towards investments in green technology factories – mainly solar panels, electric vehicles (EVs), and batteries. Although seemingly successful in its efforts to dominate these “new” sectors, China continues to struggle with its age-old internal demons of overproduction, malinvestment and domestic underconsumption. These harmful trends translate into lower growth. Thus, an increase in exports to divert overcapacity (or underconsumption) towards the rest of the world should be seen as a symptom of a misguided growth agenda rather than an intentional masterplan. Still, these rising exports in various strategic sectors set off bad blood in both the US and Europe.

Frustrated that the WTO has been unable to tame the Chinese export monster, the US is no longer pursuing a multilateral solution to this “China problem”. Rather, the two latest American presidents opted for a direct economic confrontation with China, thereby wrecking the rules-based trading order. Under the premise to keep the US technology advantage ‘as big as possible’, various export and investment controls have been put in place in combination with industrial policy efforts – the Inflation Reduction Act and the CHIPS and Science Act – that are explicitly redirecting American capital into strategic industries and phasing out Chinese dominance in its supply chains. Consequently, it could be argued that in order to backstop these investments – i.e. avoid American capital leaving the US to then import foreign-manufactured products back to the USA –, President Biden announced a series of steep tariff increases on Chinese products.

The EU, neither convinced by the Chinese nor American arguments, is taking a different approach. Under the mantra ‘de-risk, not de-couple’, the European Commission is trying to proceed its economic relationships with the rest of the world in a near-surgical fashion. A small selection of sectors, plagued by – what it deems – unfair competition, is being tackled. Unlike in Washington, Brussels’ army of trade lawyers is watching closely to ensure that this is done in full compliance with the rules set out by the World Trade Organisation. The ultimate aim is not to stifle Chinese growth, but to curb dumping and subsidy practices.

Interestingly, the Commission is increasingly acting on its own initiative. In October, it opened an investigation into market-distorting subsidisation of China’s EV industry. If ‘evidence’ of this practice is found in the coming weeks, the EU will impose – fully WTO consistent – provisional countervailing duties (CVDs – anti-subsidy duties).

It is expected that the European Commission will impose CVDs on Chinese EVs of around 15-30 % (significantly lower than the American 100 % tariffs). However, according to data from the Rhodium Group, even if duties come in at the higher end, Chinese EVs will still be able to generate high profit margins on exports to Europe due to the substantial cost advantages they enjoy. Hence, in order to succeed in its purpose in making its domestic manufacturing capacity competitive against Chinese imports, the Commission is already considering – and using – instruments beyond the traditional trade defence realm: enter the Foreign Subsidies Regulation (FSR).

Whereas the EV anti-subsidy investigation is carried out by DG TRADE, deciding on permanent tariffs on Chinese EVs will still need to be approved by a majority of the member states, the investigation on Nuctech is being executed through another channel – the newly established tool of the European Commission: the Foreign Subsidy Regulation (FSR). What makes the FSR particularly powerful is precisely that it is not a “trade defence” tool. Rather, the FSR is an “internal market” instrument, overseen by the Directorate-General for Competition (DG COMP). Although it is easy to get lost in EU-legalese, the principle of the FSR is strikingly simple: it extends rules on state-aid to foreign companies acting within the EU Single Market. Essentially, it treats Chinese (or any other country active in Europe) as a member of the EU.

The FSR has only been in effect since 12 July 2023, but already the Commission has been overwhelmed with notifications. Through this new instrument, DG COMP has already opened investigations into a variety of sectors, ranging from solar to train, and now on the security technologies sector with Nuctech.

The FSR has already proved to be a mighty weapon. As soon as Chinese train manufacturer CRRC was aware of an ongoing investigation into its public procurement procedure in Bulgaria, it withdrew its tender. The same happened with a two Chinese solar companies who withdrew their bids for a solar park in for a Romanian photovoltaic park. The “ex officio” competency the Commission holds in wielding the FSR, meaning that the Commission can start investigations unprompted by the member states or sectoral complaints, sends shivers down the spine of various foreign companies acting within the EU. Understandably, not a single company wants to have their offices raided like it was the case with Nuctech.

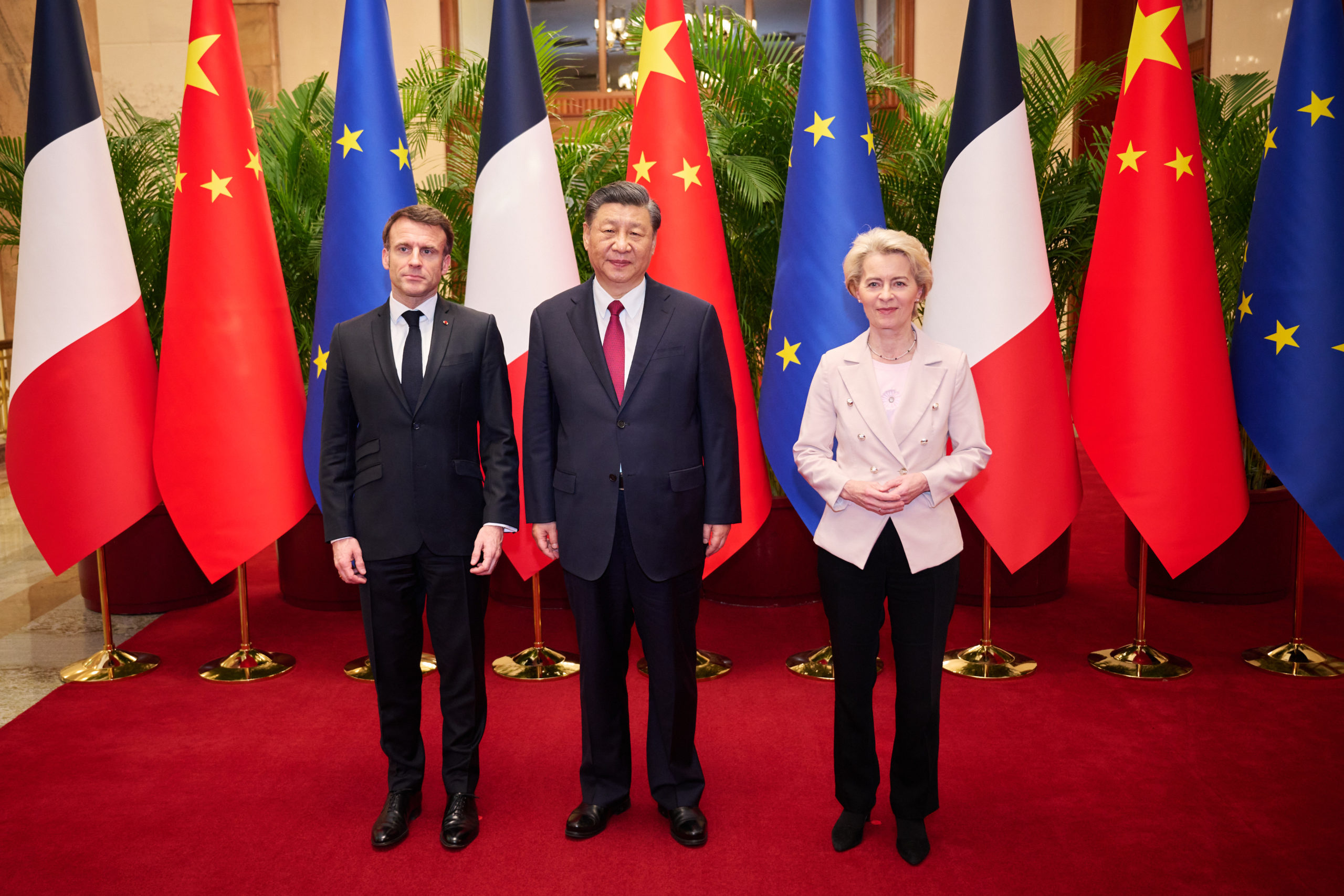

Not only foreign companies should be frightened by this new tool, also member states. This new instrument has already exposed some frictions between the Commission and during President Xi Jinping’s latest visit to France. While President Macron is openly on board with the Commission’s Anti-Subsidy EV probe, his Finance Minister indicated that France would welcome Chinese EV giant BYD to set up shop in France. After saying goodbye to Commission President Von der Leyen, Macron welcomed to the table an extensive delegation of Chinese companies, amongst which Huawei, ZTE, CRRC, striking a myriad of deals with various French companies.

In other words: Macron wants to have his cake – increased tariffs on Chinese EVs, protecting its local manufacturing base – and eat it – attracting Chinese investments in French EV factories – too.

If the EV anti-subsidy investigation report is to provide well-founded evidence that Chinese EV companies did indeed benefit from subsidies causing – or threatening to cause – injury to European industry, this might have ramifications beyond the EU-China trade. Will the Commission use this precedent to unleash the FSR to (future) Chinese EV factories in Europe? This is still an open question.

In EU trade relations, as in physics, Newton’s third law applies: for every action there is a reaction. This time is no different. It seems unlikely that China, even in the precarious economic situation it finds itself in, will fully accommodate European tariff hikes without a fight. The Chinese embassy already expressed ‘grave concern’ about the unannounced inspections. The EU was urged to stop ‘unreasonably oppressing and impeding Chinese companies.’ Chances are low that China will not retaliate against a double whammy tariff treat coming from Washington and Brussels. In an obvious retaliation, Beijing already launched an anti-dumping investigation into imports of a chemical (POM copolymer) used in automotive engineering. Some reports even indicate that a further series of retaliatory measures are to be expected, signalling wine, dairy products, and aviation products as footing the bill. The Chinese Chamber of Commerce to the EU conveyed the PRC’s message that China has “sufficient countermeasures at its disposal” if the EU continues its FSR and anti-subsidy investigations.

These threats will be – rightfully – taken into account in all European capitals, impairing the European member states’ willingness to openly support future FSR investigations and high(er) permanent European tariff on Chinese EVs. German Chancellor Olaf Scholz and Swedish Prime Minister Ulf Kristersson already voiced their concerns about stocking a trade war with China through increasing tariffs.

The results of the EV anti-subsidy investigation are to be published by the elections and the ongoing FSR investigations to be concluded thereafter. With critical decisions looming, the next European Commission will face a tough nut to crack in balancing trade fairness and internal competitiveness with geopolitical strategy.

(Photo credit: Wikipedia )